The UK housing market is witnessing a notable shift. Recent data indicates that house prices are beginning to recover.

This recovery is crucial for both buyers and sellers, as it reflects broader economic trends. Many stakeholders are hopeful for continued growth in this sector.

The improvements in house prices are attributed to various factors, including increased buyer demand and stabilizing economic conditions.

In this article, we will explore these developments in detail.

Current Market Trends

One of the main drivers of recovery is the increase in buyer demand. Recent surveys show that buyer inquiries have risen significantly. In particular, October 2024 saw a 12% increase in new inquiries, marking a four-month trend of growing interest from potential homebuyers.

The increase in inquiries suggests a renewed confidence among buyers, who are eager to explore opportunities in the market.

This trend in buyer demand is expected to continue. Many prospective buyers are motivated to secure their purchases before any potential price increases.

This urgency is fueled by rising optimism in the market, as recent trends indicate improving conditions. Overall, the sustained increase in inquiries is a positive sign for the housing market.

Sales Volume Growth

Alongside increased inquiries, sales volumes are also on the rise. There was a 9% growth in sales volumes reported for October 2024, following a 5% increase in the previous month.

This upward trajectory indicates that more transactions are taking place, as buyers capitalize on favorable conditions. The recent increase in sales volumes is a clear indicator of a recovering market.

This trend is encouraging for sellers as well. Increased sales volumes lead to a more dynamic market, creating opportunities for homeowners looking to sell.

As competition among buyers intensifies, sellers can expect to receive more competitive offers, which can drive up prices. This positive cycle contributes to an overall sense of confidence in the housing market.

Regional Variations

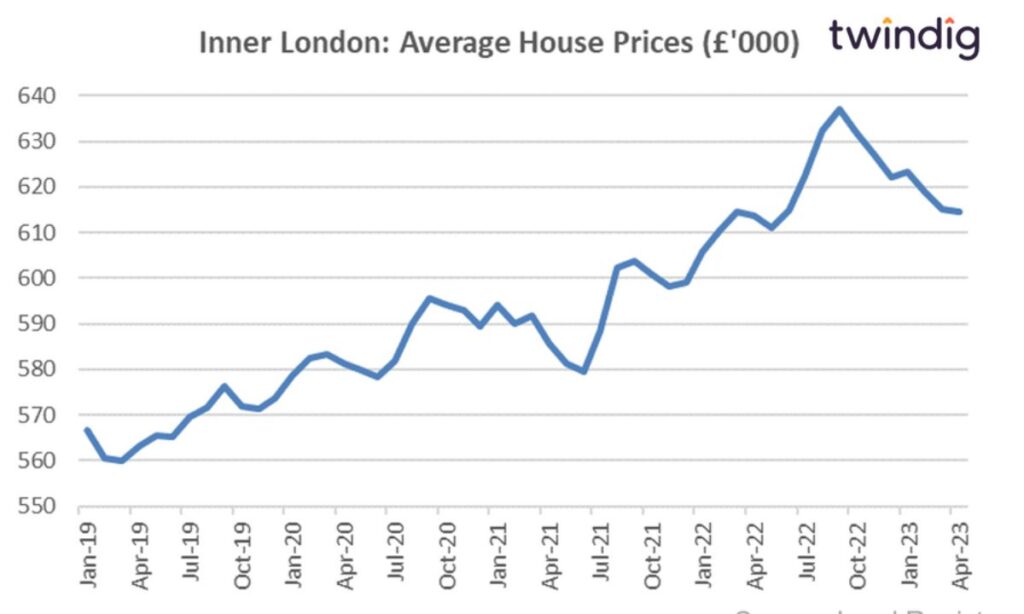

The recovery in house prices is not uniform across the UK, which means there are significant regional variations. For instance, Scotland experienced a remarkable 4.5% increase in house prices, while certain areas in London have seen declines.

These differences highlight the complexity of the housing market and the factors that influence pricing in various regions.

Buyers and sellers should be aware of local trends, as understanding these dynamics can inform better decision-making.

Different areas may have unique drivers affecting house prices, such as economic opportunities, lifestyle preferences, and the availability of housing stock.

Key Areas of Growth

Certain regions are emerging as hotspots for growth in the housing market. The North West has seen particularly strong price increases, reflecting the area’s economic development and appeal.

Other regions, such as Northern Ireland and the North East, are also performing well, indicating a broader trend of recovery outside of traditionally strong markets like London.

This regional growth can be attributed to several factors. Increased employment opportunities, coupled with desirable living conditions, are key influences. As these areas develop and attract new residents, they foster a competitive housing market that benefits both buyers and sellers.

Economic Factors role in house pricing

Economic factors play a significant role in shaping the housing market. Interest rates remain a concern for many buyers, as the Bank of England has maintained rates at 5.25%. High interest rates can create challenges for affordability, making it more difficult for potential buyers to secure financing for their homes.

However, recent inflation data shows positive trends that could enhance the housing market’s outlook. Inflation returned to the government’s target of 2% in May 2024, marking an important milestone for economic stability.

This improvement could lead to future interest rate cuts, which would enhance affordability for buyers and potentially spur greater demand in the housing market.

Read This Blog Also : How Herry Heryawan Menggoda Jessica Became an Internet Sensation

Government Policies

Government policies also significantly impact the housing market. Efforts to increase housing supply are crucial for meeting the growing demand. Policies that promote transparency and fairness in transactions can benefit all stakeholders involved in the housing market.

Industry leaders are calling for collaboration between government bodies and industry professionals. Addressing issues like affordability and housing availability is essential for fostering a healthy market.

A balanced approach that considers the needs of buyers, sellers, and investors can contribute to long-term stability in the housing sector.

Industry Reactions

Industry experts are generally optimistic about the current trends in the housing market. Jason Tebb, president of OnTheMarket, highlights the improved sentiment among buyers.

He notes that property prices and transactions are steadily increasing, which reflects a broader recovery. This positive sentiment is encouraging for both buyers and sellers, as it creates a more dynamic and competitive market.

Iain McKenzie, CEO of The Guild of Property Professionals, emphasizes the importance of stability in the market. He describes the current growth in house prices as modest yet healthy.

This provides much-needed certainty for both buyers and sellers. This period of stability can lead to a more balanced market, where both parties can benefit from ongoing demand.

Market Confidence

Confidence in the market is crucial for continued recovery, and recent data suggests that this confidence is growing. Nicky Stevenson, managing director at Fine & Country, points to increasing transaction levels as a sign of a revived market.

She believes that stable interest rates are boosting buyer confidence, encouraging more individuals to commit to purchasing homes.

Nick Leeming, chairman of Jackson-Stops, also expresses optimism about the market’s trajectory. He reports an 18% increase in new property listings, indicating strong buyer demand and a competitive environment.

This influx of listings provides buyers with more choices and suggests a healthy level of activity in the market.

Frequently Asked Questions

What are the current trends in UK house prices?

Current trends show an increase in house prices after a period of decline. Recent data indicates a 1.1% increase in the year to April 2024.

How is buyer demand changing?

Buyer demand has risen significantly. Reports indicate a 12% increase in new inquiries in October 2024, reflecting growing interest in the market.

What regions are experiencing growth?

Regions like Scotland and the North West are seeing significant growth, while some areas in London are experiencing price declines, illustrating regional variations.

How do interest rates affect house prices?

Higher interest rates can reduce affordability for buyers. However, stable rates can boost confidence and increase demand, contributing to a healthier market overall.

What should sellers consider in the current market?

Sellers should price their homes competitively and understand local market conditions. Engaging with local agents can provide valuable insights into pricing strategies to attract potential buyers.

Conclusion

House prices in the UK are showing promising signs of recovery, driven by increased buyer demand and sales volume growth. The improvements observed in various regions highlight the nuanced nature of the housing market.

Understanding these dynamics is essential for both buyers and sellers navigating this landscape.

As the UK housing market continues to evolve, stakeholders must stay informed about trends and shifts. The recovery offers opportunities for both buyers and sellers, and understanding current market conditions can lead to better decision-making.

By keeping an eye on these developments, participants in the housing market can position themselves for success in this dynamic environment.

Noor is a talented content writer and digital marketer with expertise in SEO, social media management, and online marketing.