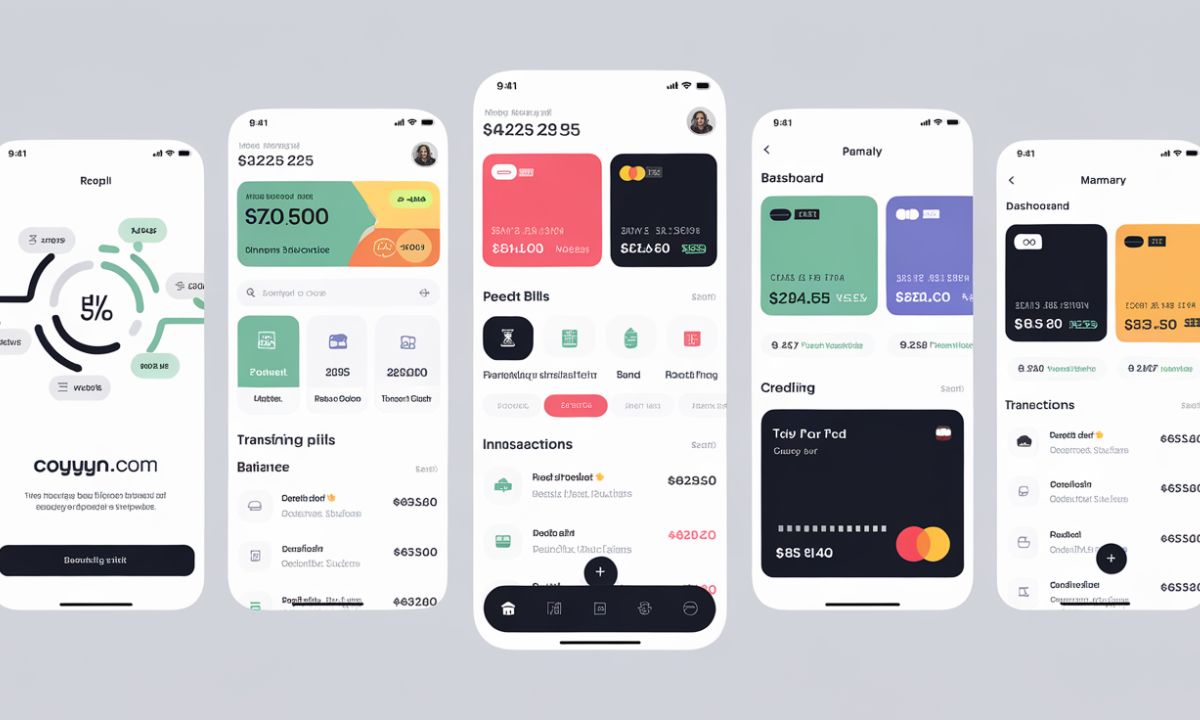

In today’s fast-paced digital world, traditional banking methods are rapidly evolving to meet the growing demands of modern consumers and businesses. coyyn.com Digital Banking stands at the forefront of this financial revolution, offering innovative solutions that transform how we manage money in the digital age.

This comprehensive platform combines cutting-edge technology with user-friendly features to deliver a seamless banking experience that caters to both individual and business needs.

What is coyyn.com Digital Banking?

coyyn.com Digital Banking represents a new era in financial services, providing a comprehensive digital banking platform that enables users to manage their finances entirely online. This innovative solution eliminates the need for physical bank visits while offering a full range of banking services at your fingertips. The platform integrates advanced technology with traditional banking services, creating a secure and efficient environment for all your financial needs.

As a pioneer in the digital banking sector, coyyn.com has revolutionized the way people interact with their money. The platform combines sophisticated technology with intuitive design, making financial management accessible to everyone, regardless of their technical expertise. This digital banking solution operates 24/7, ensuring that users have constant access to their finances and banking services whenever they need them.

Key Features of coyyn.com Digital Banking

Convenient Access Anytime, Anywhere

Digital banking with coyyn.com transforms your smartphone or computer into a powerful financial management tool. The platform’s robust mobile application and web interface ensure that your banking services are always within reach, regardless of your location. This accessibility extends across multiple devices, allowing seamless transitions between your smartphone, tablet, and computer while maintaining consistent functionality and user experience.

The platform’s interface is designed for optimal performance across all devices, ensuring that users can easily navigate and complete transactions whether they’re at home, in the office, or traveling abroad. The synchronization across devices means that any changes or transactions made on one device are instantly reflected across all others, maintaining perfect consistency in your financial management.

Read This Blog: The Pizza Edition Windows 11: A Fun Twist on Microsoft’s OS

Enhanced Security Measures

Security stands as a cornerstone of coyyn.com’s digital banking platform. The system employs multiple layers of security protocols, including advanced encryption, biometric authentication, and real-time fraud detection systems. These comprehensive security measures work together to protect users’ financial information and transactions from unauthorized access and cyber threats.

The platform regularly updates its security protocols to stay ahead of emerging threats, implementing the latest technological advancements in cybersecurity. Multi-factor authentication adds an extra layer of protection, while continuous monitoring systems alert users to any suspicious activity on their accounts, providing peace of mind for all financial transactions.

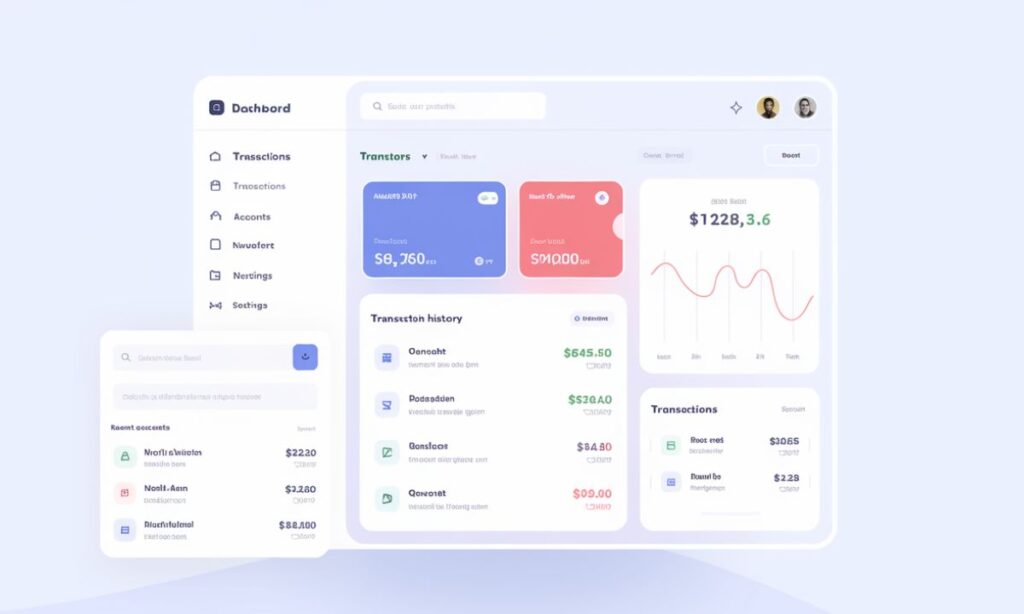

Wide Range of Financial Services

coyyn.com Digital Banking offers an extensive array of financial services that cater to diverse banking needs. From basic banking operations to sophisticated financial management tools, the platform provides a comprehensive suite of services that rival traditional banking institutions. Users can perform standard banking operations like transfers and deposits, while also accessing advanced features such as investment management and foreign exchange services.

The platform continually expands its service offerings to meet evolving customer needs, incorporating new financial tools and features based on user feedback and market demands. This commitment to service expansion ensures that users have access to the latest financial management capabilities without needing to switch between multiple providers.

The Advantages of coyyn.com Digital Banking for Businesses

Seamless Payment Solutions

Business operations benefit significantly from coyyn.com’s integrated payment solutions. The platform offers various payment options, including bulk payments, recurring transactions, and international transfers, all designed to streamline business financial operations. These payment solutions integrate seamlessly with popular accounting software, reducing manual data entry and improving accuracy in financial record-keeping.

The platform’s payment infrastructure supports multiple currencies and payment methods, making it ideal for businesses operating in international markets. Real-time payment processing and instant confirmation notifications help businesses maintain efficient cash flow management and improve their relationship with suppliers and customers.

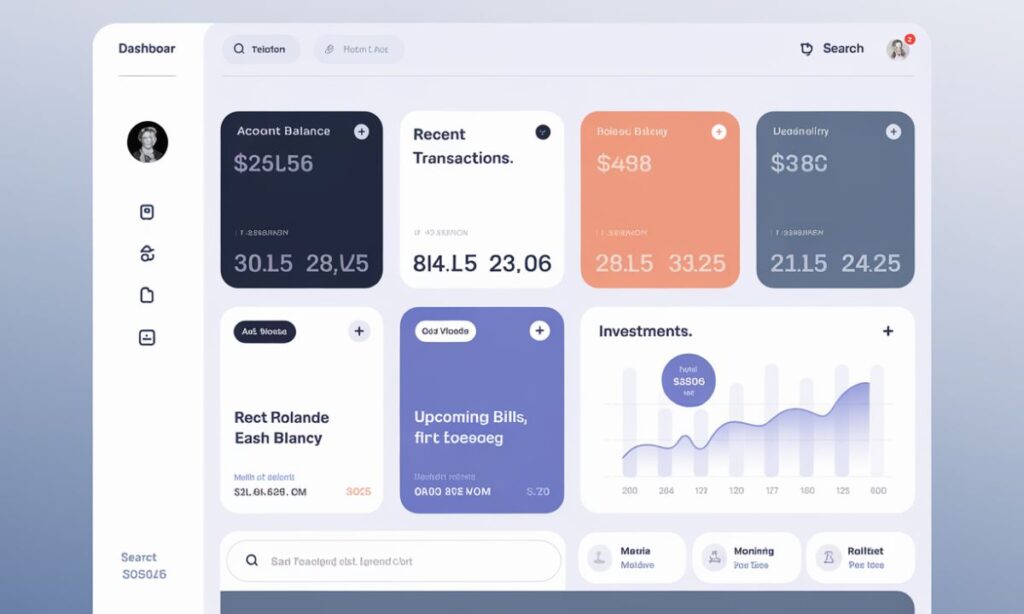

Real-Time Financial Insights

coyyn.com provides businesses with powerful analytical tools that offer immediate insights into their financial performance. The platform generates detailed reports and visualizations that help business owners and managers make informed decisions based on current financial data. These insights cover various aspects of business finances, including cash flow analysis, expense tracking, and revenue patterns.

The real-time nature of these insights allows businesses to respond quickly to changing financial situations and identify opportunities or challenges as they arise. Custom reporting features enable businesses to focus on specific aspects of their financial performance that matter most to their operations.

Scalable Services for Growing Businesses

As businesses evolve and grow, coyyn.com’s digital banking platform scales accordingly to meet changing needs. The platform offers flexible service packages that can be adjusted based on business size and requirements, ensuring that companies only pay for the services they need. This scalability extends to user management, allowing businesses to add or remove users and adjust access levels as their team grows.

The platform’s architecture supports increasing transaction volumes and complex financial operations without compromising performance or security. This scalability makes coyyn.com an ideal banking partner for businesses at any stage of their growth journey.

Personal Finance Made Simple with coyyn.com Digital Banking

Budgeting and Expense Tracking

Personal financial management becomes effortless with coyyn.com’s comprehensive budgeting tools. The platform automatically categorizes expenses and provides detailed spending analysis, helping users understand their financial habits better. Visual representations of spending patterns make it easy to identify areas where savings can be achieved and track progress toward financial goals.

The system’s intelligent algorithms learn from user spending patterns to provide personalized insights and recommendations for better financial management. These features help users develop better financial habits and make more informed decisions about their money.

Automated Bill Payments

coyyn.com simplifies regular financial obligations through its automated bill payment system. Users can schedule recurring payments for utilities, subscriptions, and other regular expenses, ensuring that bills are paid on time without manual intervention. The platform sends reminders before payments are due and confirms successful transactions, helping users avoid late fees and maintain good payment records.

The automation extends to payment scheduling, allowing users to set up future payments and recurring transfers based on their preference and cash flow patterns. This feature helps in maintaining consistent bill payment schedules while reducing the time spent on routine financial tasks.

Read This Blog: Unlock For Fun with The Pizza Edition Games Guide to Unblocked Gaming

Savings and Investment Opportunities

The platform provides various tools and opportunities for users to grow their wealth through savings and investments. Users can create multiple savings goals, track their progress, and automatically allocate funds to different savings objectives. The platform offers competitive interest rates on savings accounts and provides access to various investment options suitable for different risk appetites.

Investment features include portfolio management tools, market insights, and automated investment options that help users make informed decisions about their financial future. The platform’s educational resources provide valuable information about different investment strategies and financial planning concepts.

Why Choose coyyn.com Digital Banking?

Choosing coyyn.com as your digital banking partner offers numerous advantages that set it apart from traditional banking institutions and other digital banking platforms. The combination of innovative technology, comprehensive services, and user-friendly design makes it an ideal choice for both personal and business banking needs. The platform’s commitment to security, continuous improvement, and customer satisfaction ensures a reliable and evolving banking experience.

The platform’s integration capabilities with other financial tools and services create a comprehensive ecosystem that simplifies financial management. Regular updates and new feature releases ensure that users always have access to the latest banking technology and services.

Conclusion

The future of banking is digital, and coyyn.com leads the way in providing innovative, secure, and comprehensive digital banking solutions. Whether you’re an individual looking to simplify your personal finances or a business seeking efficient financial management tools, coyyn.com Digital Banking offers the perfect blend of technology and banking services to meet your needs.

As we continue to move toward a more digital future, partnering with a forward-thinking digital banking platform becomes increasingly important. coyyn.com’s commitment to innovation, security, and user experience makes it an excellent choice for anyone looking to embrace the future of banking while maintaining control over their financial life.

Frequently Asked Questions

What types of accounts can I open with coyyn.com Digital Banking?

You can open personal checking, savings, business accounts, and investment accounts, all managed through a single platform.

How secure is coyyn.com Digital Banking?

The platform employs bank-grade security measures, including encryption, multi-factor authentication, and continuous monitoring systems.

Can I access coyyn.com Digital Banking from multiple devices?

Yes, you can securely access your accounts from any device with internet connectivity, including smartphones, tablets, and computers.

Are there any monthly fees for using coyyn.com Digital Banking?

Fee structures vary based on account types and service levels, with multiple options available to suit different needs.

How quickly are transfers processed on coyyn.com?

Most domestic transfers are processed instantly, while international transfers typically complete within 1-3 business days.

Can businesses integrate coyyn.com with accounting software?

Yes, the platform offers seamless integration with popular accounting software for efficient business financial management.

What customer support options are available?

24/7 customer support is available through multiple channels, including phone, email, and live chat.

Is mobile check deposit available?

Yes, users can deposit checks instantly using their smartphone camera through the mobile banking app.

Can I set up recurring payments for bills?

Yes, the platform offers automated bill payment features for both one-time and recurring payments.

How does coyyn.com protect against fraud?

The platform uses advanced fraud detection systems and real-time monitoring to protect against unauthorized transactions.

Noor is a talented content writer and digital marketer with expertise in SEO, social media management, and online marketing.